Rent 2 Own Advantages

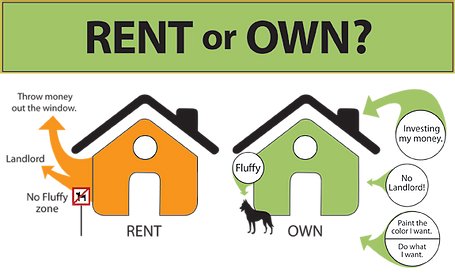

There are several advantages to buying rent to own homes.

Time

While renting the home, buyer-tenants have a period of time (usually 1 to 3 years) in order to prepare and make arrangements for the ultimate purchase of the rent to own home.

During this time, buyers with imperfect credit can work to improve their ratings with an eye on approving them for a future home loan. The time period also allows buyers to pay off other debts they may hold, or increase their savings for a future down payment.

Commitment, with an Out

Getting into a rent to own house is a serious commitment for both buyer and seller. The reason buyers enter into the agreement is to finally purchase the home of their choice. But there are those rare situations where circumstances cause the buyer to not execute the home purchase. That’s OK because the rent to own commitment can be terminated without a purchase of the home. This allows the buyer some flexibility to get ‘out’ or walk away before making the final long term purchase commitment.

Of course, in these cases, the buyer will most likely lose all the money they paid toward the Option Fee, plus other credits earned or deposits made, but sometimes that cost is worth avoiding making a final purchase that turned out to be not right for some reason.

Using Credits on the Option

For example, if the home rental rate is $800 per month and $400 of this amount is applied to the home purchase, after a 36 month rental term, the buyer would accumulate $14,400 to apply to the purchase.

Building Non-Cash Equity

It’s a reality that homes need upkeep. Agreeing to take on certain parts of home maintenance while renting can add equity for the buyer. When the buyer pitches in to do repairs or upgrades, the value of the property is enhanced. In addition, by acting as the seller’s maintenance resource, the buyer can ask for the value of the work performed be included as an Option Credit.

For example, if the seller would otherwise need to pay someone $1,000 to make a repair, and the buyer can do the same work for $300, it is not unreasonable for the buyer to ask for a $1,000 Option Credit, thereby pocketing $700 in sweat equity value.

Rent to own is a clear winner for those buyers who are serious about fulfilling their dream of home ownership, but have an obstacle in the way, such as an uncooperative lender, an issue with credit rating or a need to build up a down payment over time. Purchasing a home to rent with an option to buy helps buyers find a means to overcome theses issues.

Need more details? Contact us

We are here to assist. Contact us by phone, email or via our Social Media channels.